APG on behalf of its clients uses its influence to improve companies’ sustainability and long-term performance. In this series, we explore how stewardship is applied in the different asset classes and strategies making up APG’s diversified portfolio. In this first installment, Jan-Willem Ruisbroek and Cameron Talbot-Stern zoom in on infrastructure. “We’re glad to see ever more infrastructure investors incorporating sustainability in their stewardship activities.”

APG is a global investor in infrastructure with a diversified portfolio of nearly € 25 billion in assets under management, including investments in transport (e.g. electric vehicle chargers, toll roads, rail, ports), telecom (e.g. fiber optics), power (e.g. wind and solar farms), and water and waste water infrastructure. Recent investments include Gemini, a solar and storage project in the US, and Glaspoort, a joint venture with KPN for the rollout of fiber-optic connections to homes in less urbanized parts of the Netherlands.

Tangible benefits

“Our aim is to not only achieve solid returns for our pension fund clients, but also to generate tangible benefits that contribute to the well-being of society”, says Jan-Willem Ruisbroek, Head of Global Infrastructure Investment Strategy at APG. Over one-third (€ 8.5 billion) of APG’s infrastructure portfolio contributes to the Sustainable Development Goals, in particular SDG 7 (Affordable & Clean Energy), SDG 9 (Industry, Innovation and Infrastructure) and SDG 11 (Sustainable Cities & Communities). But investing in solutions to the world’s challenges is not the only way in which APG and its clients contribute to a better world.

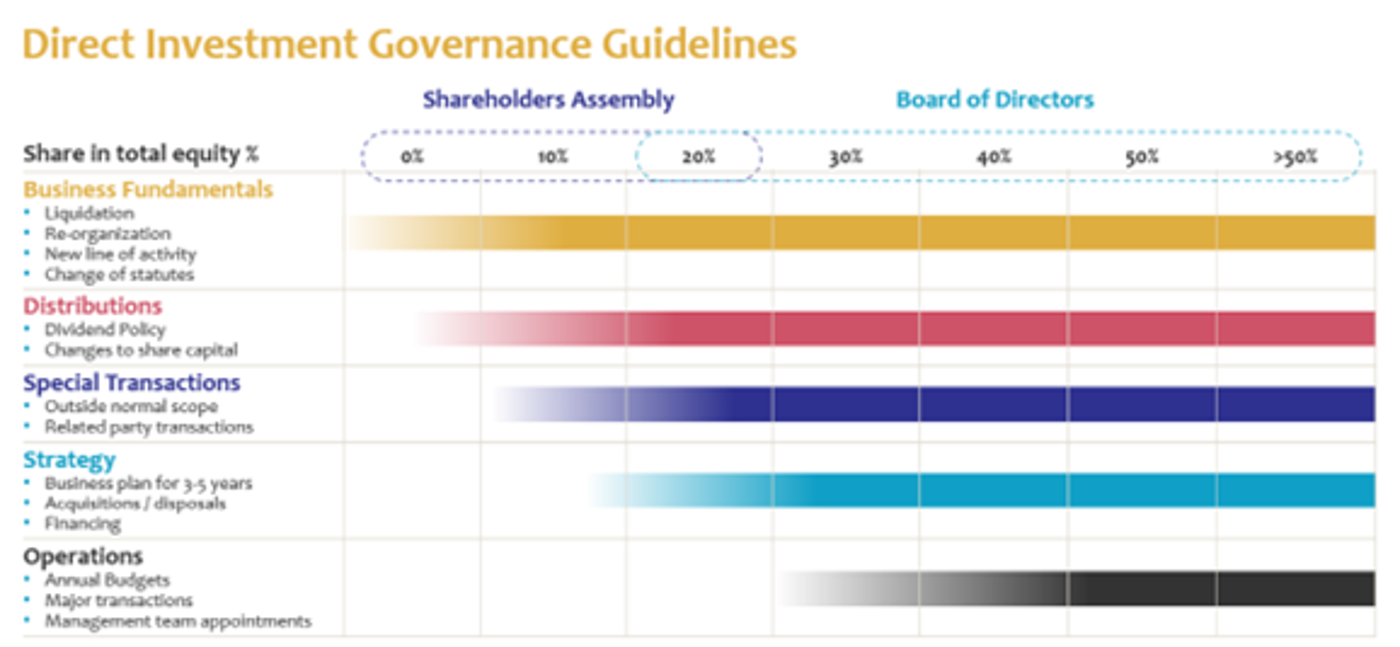

According to the Principles for Responsible Investment (PRI) private-market investors, in particular those with direct exposure to real assets, are in an excellent position when it comes to stewardship, due to the large and sometimes controlling interests in their investments. “APG generally aims to obtain a significant stake in an infrastructure asset, typically 20 to 50 percent of the equity, as this increases our influence,” Jan-Willem explains. “In very general terms, the larger the stake we own, the more we have to say about the asset’s strategy and operations and the better we can encourage investees to improve their environmental, social and governance (ESG) practices.”

APG uses the below best-practices in negotiations on governance and controls in private infrastructure investments.